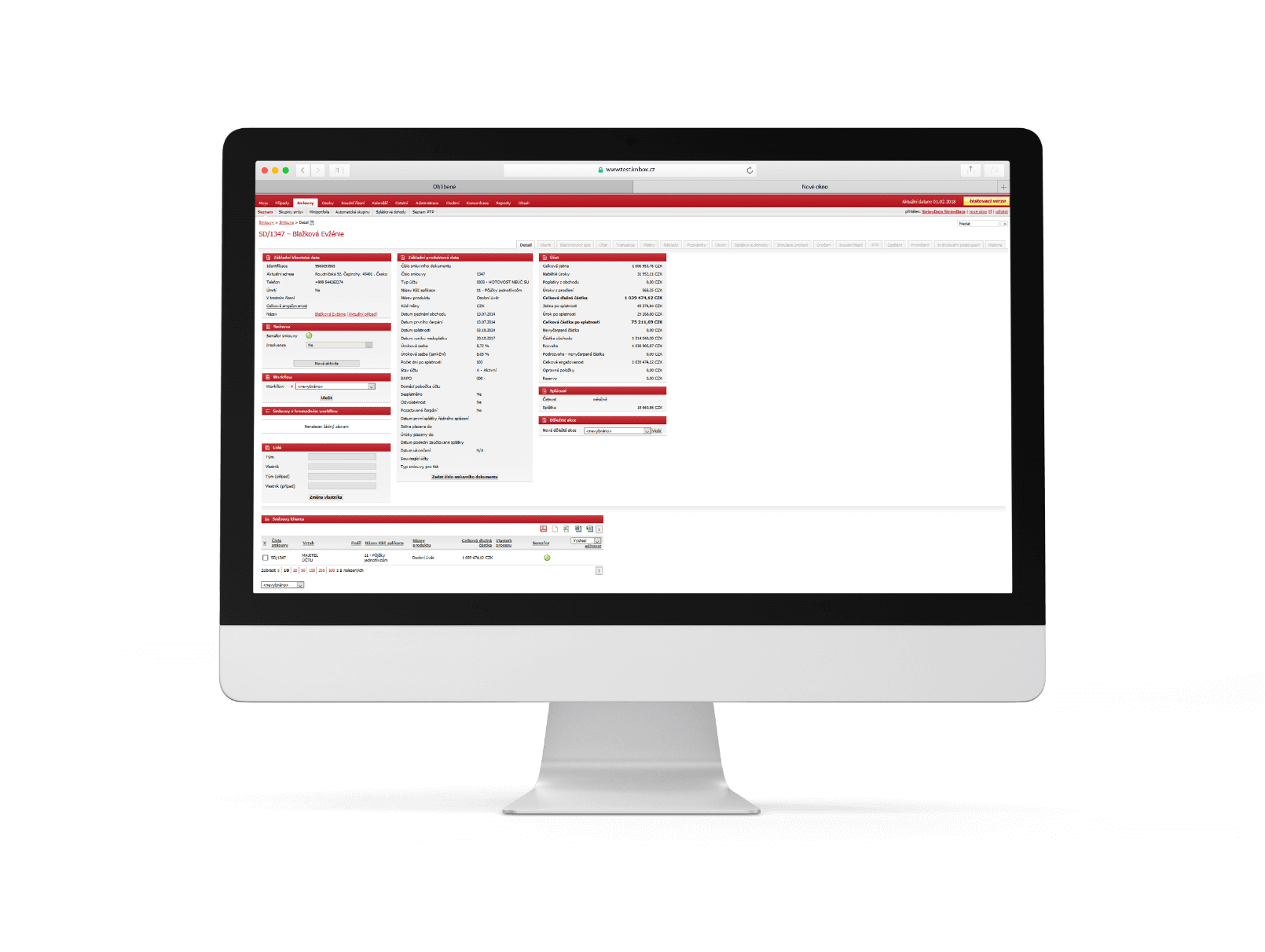

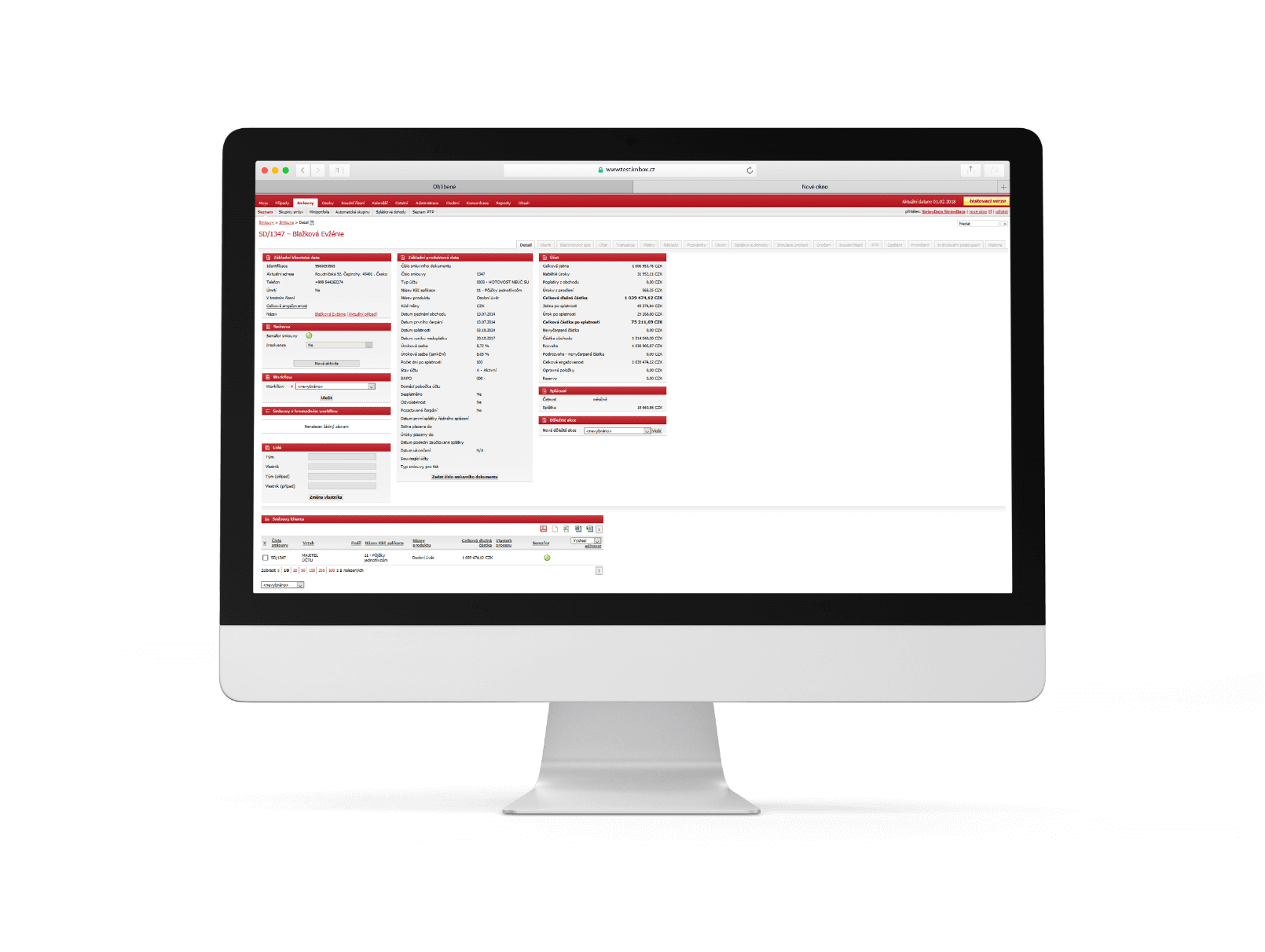

How LoanOffice works

LoanOffice is a debt recovery information system. It supports the entire debt recovery process from the automation of pre-collection and soft collection, all the way through to the management and recording of debt recovery through legal action, the sale of receivables or their write-off. You can also use it for selected administrative operations only. For example, workouts or insolvency management.